How to find mispriced options images are ready. How to find mispriced options are a topic that is being searched for and liked by netizens now. You can Get the How to find mispriced options files here. Get all royalty-free images.

If you’re looking for how to find mispriced options images information linked to the how to find mispriced options topic, you have visit the right site. Our website frequently provides you with hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

The 1680 Put is the correct answer. Now it is time to delve into the practical to see how options work in the market. You can then take it a step further to actually find and act on these opportunities. Like you will never find a longer term option at the same strike to be cheaper than the one in a short term. Intrinsic valuation methods allow investors to calculate the value of an underlying business independent of other companies and market pricing.

How To Find Mispriced Options. A green drop is great or good a yellow drop is fair or poor and a red drop is none. Like you will never find a longer term option at the same strike to be cheaper than the one in a short term. You can see in the example below that IBKR is trading for 6446. Swinging for the Fences is my amazing original course and its all about showing you how to produce enormous revenues with mispriced options trading lower than 50 cents each.

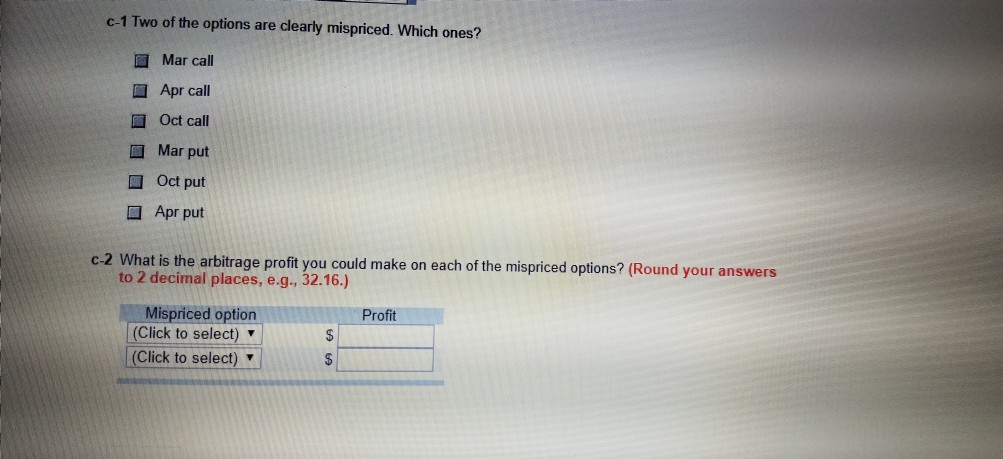

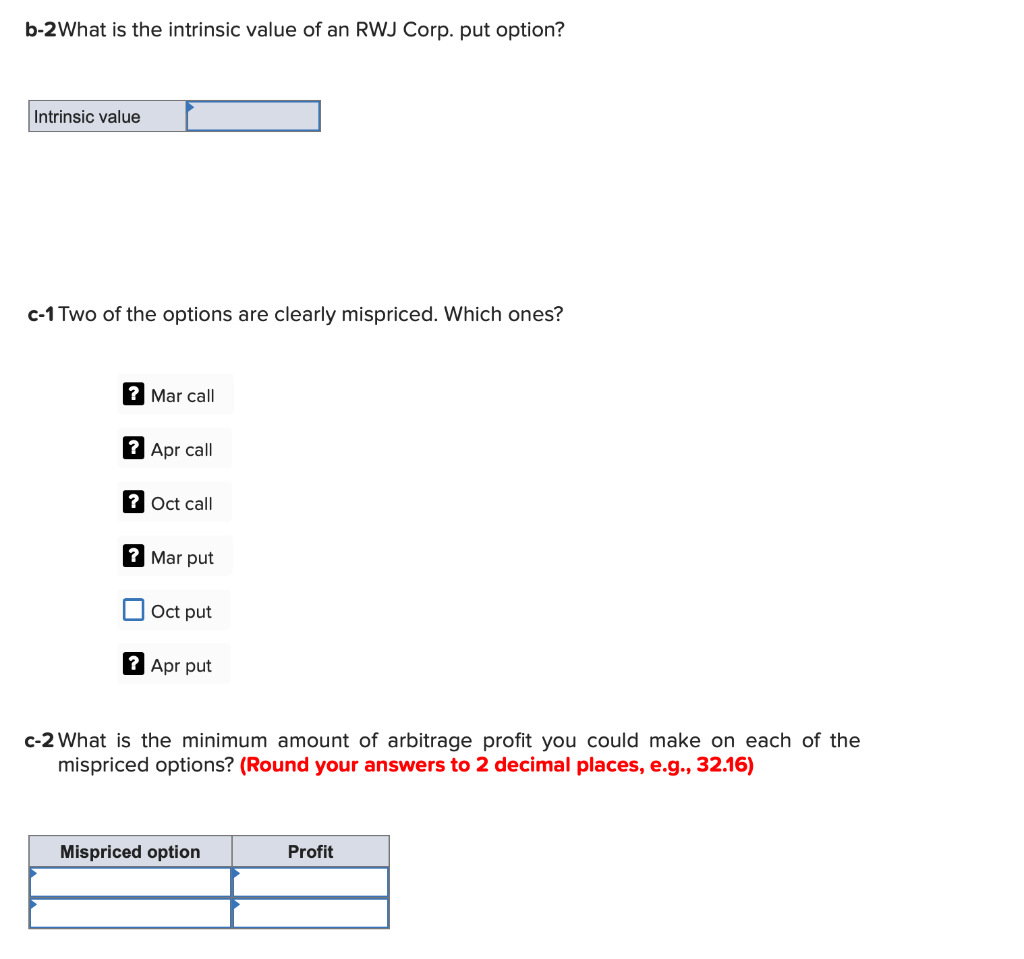

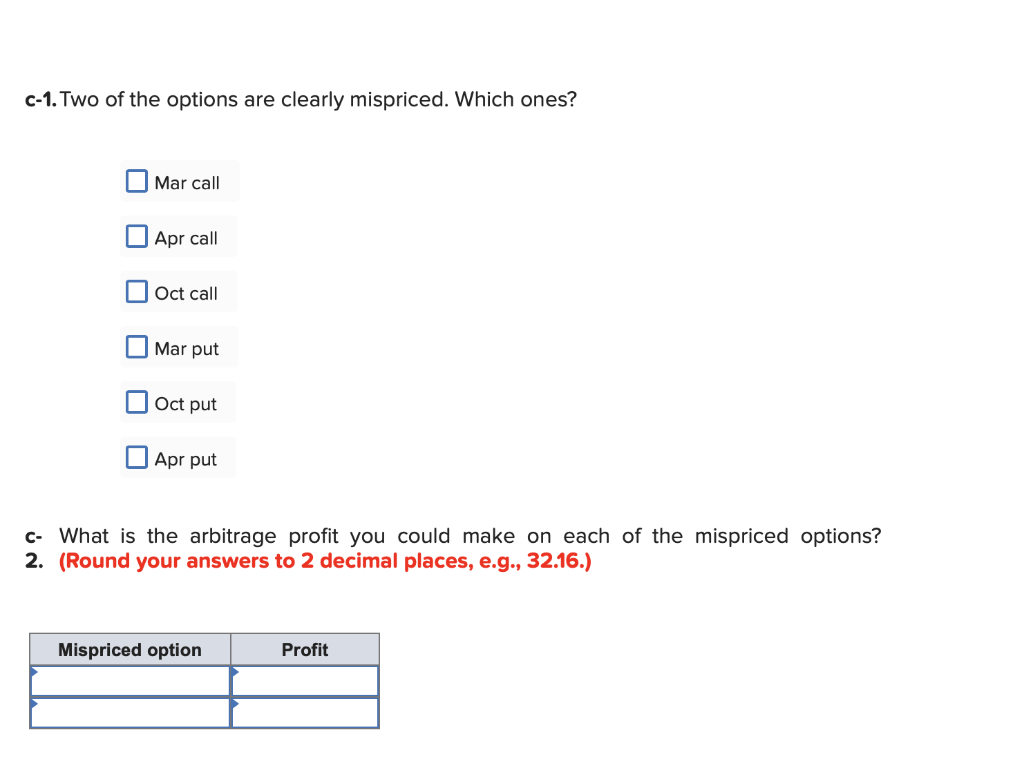

Solved C 1 Two Of The Options Are Clearly Mispriced Whic Chegg Com From chegg.com

Solved C 1 Two Of The Options Are Clearly Mispriced Whic Chegg Com From chegg.com

After finishing this chapter you should understand 1. Any stock that has options and is up 25 to 30 on the day could be a good place to start. Option-specific pricing features such as a wide bid-ask spread. How to Profit from Mispriced Options. The call options need at least 100 days of expiry let in them and a delta of 15 or less. There is a way to simply eyeball for mispriced options.

C call P put S Stock X Strike I Interest D Dividends.

This is probably the most common strategy that most regulated and. The 1680 Put is the correct answer. Make sure the options are underpriced and have a probability of profit of at least. The options of interest are the ones with a strike price far away from 6446. Trying graphing them in excel and youll see a kink in the line for the put option prices at 9189. Like you will never find a longer term option at the same strike to be cheaper than the one in a short term.

Source: chegg.com

Source: chegg.com

It holds the entire options universe together. The stock has to have tradable options both far out in time and far away from the strike price. I dont think you can find any options that is theoretically mispriced. No matter how. A ll our option-related discussions so far have been theoretical.

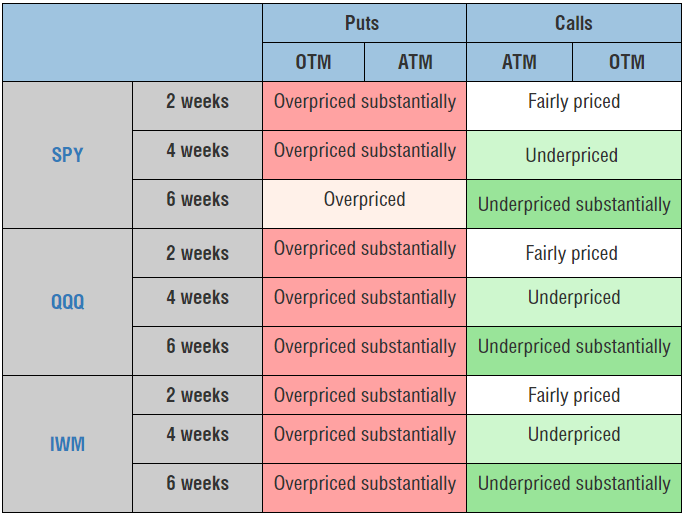

Source: quantcha.com

Source: quantcha.com

C call P put S Stock X Strike I Interest D Dividends. Finally you can jump into the options search engine for a given expiration using the Trade dropdown. Put-call parity is kind of like the duct tape of the options world. A ll our option-related discussions so far have been theoretical. As an investor you are most likely to find a mispriced stock when other buyers and sellers of the stock are buying and selling for trading reasons rather than investing reasons.

Source: quantcha.com

Source: quantcha.com

How to read an option chain pricing screen 2. It holds the entire options universe together. C-P S-X I-D Where. In the EU for example. Make sure the options are underpriced and have a probability of profit of at least.

Source: pinterest.com

Source: pinterest.com

The call options need at least 100 days of expiry let in them and a delta of 15 or less. Put-call parity is kind of like the duct tape of the options world. Try to find options that are priced under 150 and whose strike price is close to the market value of the stock. In addition to traditional charts like implied volatility by strike you can plot a variety of option properties against each other. Option-specific pricing features such as a wide bid-ask spread.

Source: in.pinterest.com

Source: in.pinterest.com

As an investor you are most likely to find a mispriced stock when other buyers and sellers of the stock are buying and selling for trading reasons rather than investing reasons. Put-call parity is kind of like the duct tape of the options world. A ll our option-related discussions so far have been theoretical. After finishing this chapter you should understand 1. The 1680 Put is the correct answer.

Source: seekingalpha.com

Source: seekingalpha.com

Technical analysis allows investors to identify. How to Profit from Mispriced Options. How to read an option chain pricing screen 2. As an investor you are most likely to find a mispriced stock when other buyers and sellers of the stock are buying and selling for trading reasons rather than investing reasons. Consequently a key feature of options is that the losses on an option position are limited to what you paid for the option.

Source: youtube.com

Source: youtube.com

Options Arbitrage As derivative securities options differ from futures in a very important respect. The options of interest are the ones with a strike price far away from 6446. Now it is time to delve into the practical to see how options work in the market. No matter how. There is a way to simply eyeball for mispriced options.

Source: chegg.com

Source: chegg.com

Theres no such thing as mispriced options that you can trade to make money. The call options need at least 100 days of expiry let in them and a delta of 15 or less. Theres no such thing as mispriced options that you can trade to make money. They represent rights rather than obligations calls gives you the right to buy and puts gives you the right to sell. The stock has to have tradable options both far out in time and far away from the strike price.

Source: seekingalpha.com

Source: seekingalpha.com

As an investor you are most likely to find a mispriced stock when other buyers and sellers of the stock are buying and selling for trading reasons rather than investing reasons. After finishing this chapter you should understand 1. Like you will never find a longer term option at the same strike to be cheaper than the one in a short term. Finally you can jump into the options search engine for a given expiration using the Trade dropdown. Theres no such thing as mispriced options that you can trade to make money.

Source: pinterest.com

Source: pinterest.com

Swinging for the Fences is my amazing original course and its all about showing you how to produce enormous revenues with mispriced options trading lower than 50 cents each. In the EU for example. If the third drop is green it supports LEAP options. This is probably the most common strategy that most regulated and. If the second icon is green then the stock offers weekly options.

Source: youtube.com

Source: youtube.com

The options of interest are the ones with a strike price far away from 6446. You can then take it a step further to actually find and act on these opportunities. The big bull-market bet From 2004 to 2008 Berkshire took on massive amounts of exposure in the options market selling put options on major stock market benchmarks covering the US UK Japan. Options Arbitrage As derivative securities options differ from futures in a very important respect. There is a way to simply eyeball for mispriced options.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to find mispriced options by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.