Fidelity u s bond index fund premium class images are available. Fidelity u s bond index fund premium class are a topic that is being searched for and liked by netizens today. You can Find and Download the Fidelity u s bond index fund premium class files here. Get all royalty-free photos.

If you’re looking for fidelity u s bond index fund premium class images information connected with to the fidelity u s bond index fund premium class interest, you have come to the right blog. Our website always provides you with suggestions for viewing the highest quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

Aggregate Bond Index is an unmanaged market value-weighted index for US. Established in 1957 the SP 500 was the 1 st market-cap-weighted stock market index in the US. Bond Index Fund having Symbol FXNAX for type mutual-funds and perform research on other mutual funds. Valuation growth profitability momentum EPS revisions. See fund information and historical performance for the Fidelity US.

Fidelity U S Bond Index Fund Premium Class. Had the Institutional Premium Class expense ratio been reflected total. Valuation growth profitability momentum EPS revisions. Treasury purchases traded with a Fidelity representative a flat charge of 1995 per trade applies. View analyze the FSITX fund chart by total assets risk rating Min.

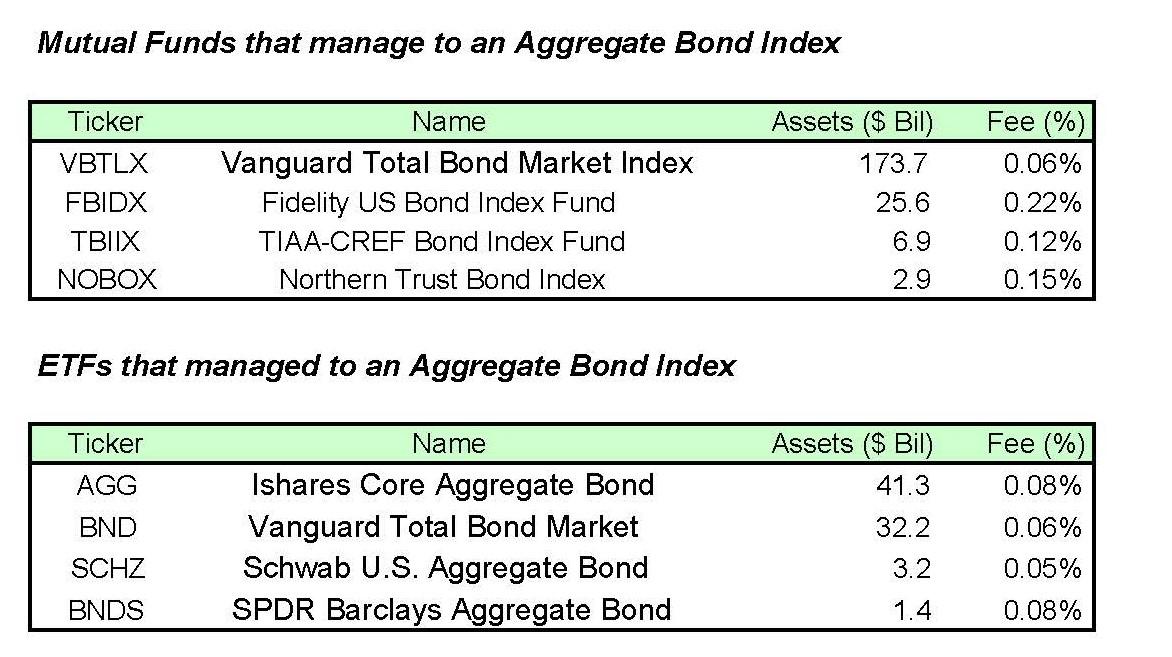

Domestic Equity International Equity Asset Allocation Fixed Income Ppt Download From slideplayer.com

Domestic Equity International Equity Asset Allocation Fixed Income Ppt Download From slideplayer.com

To be included in this index bonds must have cash flows linked to an inflation index be sovereign issues denominated in US. Rates are for US. Fidelity Global ex US. Bond Index Fund having Symbol FXNAX for type mutual-funds and perform research on other mutual funds. Analyze the Fund Fidelity US. Aggregate Bond Index using a smaller number of securities.

Normally investing at least 80 of the funds assets in bonds included in the Bloomberg Barclays US.

Using statistical sampling techniques based on duration maturity interest rate sensitivity security structure and credit quality to attempt to replicate the returns of the Index using a smaller number of securities. Had the Institutional Premium Class expense ratio been reflected total. Analyze the Fund Fidelity US. For funds other than money market funds unit values change frequently. Since the first US-listed bond ETF was launched in 2002 bond ETFs have accumulated over 800 billion in assetsalthough that is still a fraction of the roughly 36 trillion bond mutual fund market. The index covers about 80 of the investable market capitalization of the US.

Source: fintel.io

Source: fintel.io

The fund normally invests at least 80 of the funds assets in bonds included in the Bloomberg Barclays US. Bond Index Fund - Institutional Premium Class. Under our new ratings framework which places greater emphasis on fees the fund warrants an upgrade to a. Valuation growth profitability momentum EPS revisions. 2 Morningstar as of 123116.

Source: seekingalpha.com

Source: seekingalpha.com

Currently the SP 500 is used globally as a benchmarking tool to reflect the market performance of. Index Fund Series Fund code. Investment market cap and category. Normally investing at least 80 of the funds assets in bonds included in the Bloomberg Barclays US. The fund normally invests at least 80 of the funds assets in bonds included in the Bloomberg Barclays US.

Source: fintel.io

Source: fintel.io

Since the first US-listed bond ETF was launched in 2002 bond ETFs have accumulated over 800 billion in assetsalthough that is still a fraction of the roughly 36 trillion bond mutual fund market. A 250 maximum applies to all trades reduced to a 50 maximum for bonds maturing in one year or less. Mutual funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. Find our live Fidelity Us. Using statistical sampling techniques based on duration maturity interest rate sensitivity security structure and credit quality to attempt to replicate the returns of the Index using a smaller number of securities.

Source: institutional.fidelity.com

Source: institutional.fidelity.com

Since the first US-listed bond ETF was launched in 2002 bond ETFs have accumulated over 800 billion in assetsalthough that is still a fraction of the roughly 36 trillion bond mutual fund market. See fund information and historical performance for the Fidelity US. Bond Index Fund Inst FXNAX Key Stats Comparison. The index covers about 80 of the investable market capitalization of the US. Normally investing at least 80 of the funds assets in bonds included in the Bloomberg Barclays US.

Source: fintel.io

Source: fintel.io

Aggregate Bond Index using a smaller number of securities. Currency and have more than one year to maturity and as a portion of the index total a minimum amount outstanding of 100 million US. Bond funds up close. Aggregate Bond Index using a smaller number of securities. To be included in this index bonds must have cash flows linked to an inflation index be sovereign issues denominated in US.

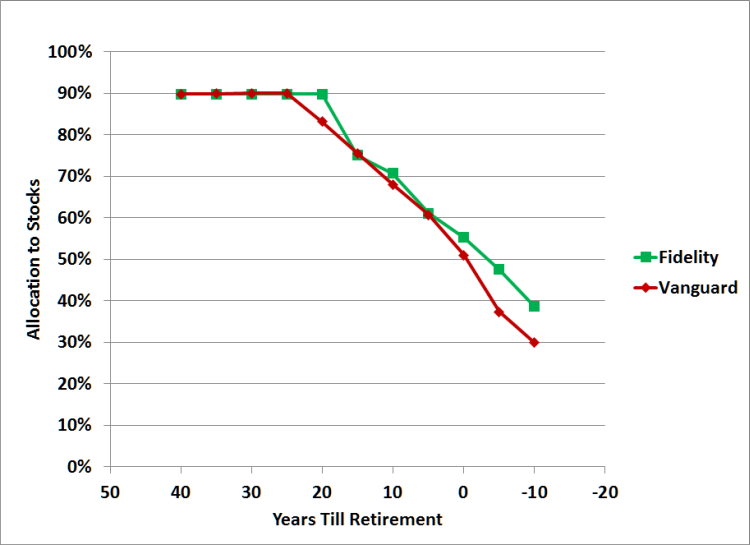

Source: thefinancebuff.com

Source: thefinancebuff.com

Index Fund - Premium Class. Find our live Fidelity Us. Under our new ratings framework which places greater emphasis on fees the fund warrants an upgrade to a. Bond Index Fund - Institutional Premium Class. Bond funds up close.

REIT sector is changing hands at a price-to-funds-from-operations FFO an. Dollar denominated investment-grade fixed-rate debt issues including government corporate asset-backed and mortgage-backed securities with maturities of at least one year. Additional fees and minimums apply for non-dollar bond trades. Companies that make up 80 of US. Mutual funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer.

Source: reddit.com

Source: reddit.com

REIT sector is changing hands at a price-to-funds-from-operations FFO an. Bond Index Fund Premium Class fund basic information. Rates are for US. Analyze the Fund Fidelity US. Had the Institutional Premium Class expense ratio been reflected total.

Source: fintel.io

Source: fintel.io

Rates are for US. Since the first US-listed bond ETF was launched in 2002 bond ETFs have accumulated over 800 billion in assetsalthough that is still a fraction of the roughly 36 trillion bond mutual fund market. For instance if one municipal bond category falls just across the dividing line from another municipal bond category even though both invest in very similar types of assets both categories are adjusted so that they are given the same risk assignment. Bond Index Fund Premium Class fund basic information. Equity by market cap.

Aggregate Bond Index is an unmanaged market value-weighted index for US. Aggregate Bond Index using a smaller number of securities. Bond funds up close. Dollar denominated investment-grade fixed-rate debt issues including government corporate asset-backed and mortgage-backed securities with maturities of at least one year. Rates are for US.

Source: fintel.io

Source: fintel.io

It is widely regarded. Index Fund Series Fund code. Fidelity Global ex US. Compare with other stocks by metrics. The Bloomberg Barclays US.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fidelity u s bond index fund premium class by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.